| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

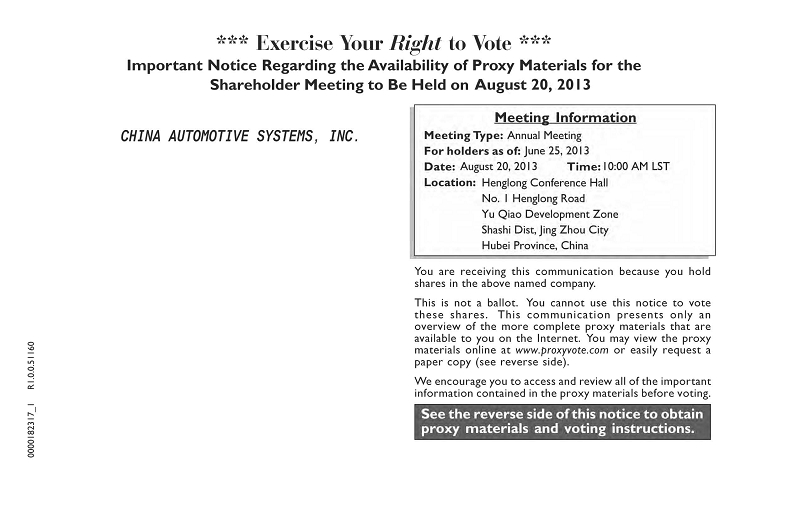

CHINA AUTOMOTIVE SYSTEMS, INC.

------------------------------------------------------------------------------------------------

Notice of Annual Meeting of Stockholders

To Be Held On October 12, 2011

The Annual Meeting of Stockholders of China Automotive Systems, Inc. (the “Company”) will be held on October 12, 2011 (Wednesday)August 20, 2013 (Tuesday) at 10:00 ama.m. local time at the conference room of the Ambassador Hotel, 818 WanhangduHenglong Conference Hall, No. 1 Henglong Road, Shanghai 200042Yu Qiao Development Zone, Shashi District, Jing Zhou City, Hubei Province, China for the following purposes, as more fully described in the accompanying proxy statement, to:

| 1. | elect five directors of the Company, to hold office until the |

| 2. | ratify the appointment of PricewaterhouseCoopers Zhong Tian |

| 3. |

| 4. |

| transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only stockholders of record at the close of business on August 15, 2011June 25, 2013 (the “Stockholders”) will be entitled to notice of, and to vote at, such meeting or any adjournments or postponements thereof.

| BY ORDER OF THE BOARD OF DIRECTORS | ||

Chen Hanlin | ||

Chairman | ||

Hubei, The People’s Republic of China

June 26, 2013

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE EXECUTE THE PROXY FOLLOWING THE INSTRUCTIONS SET FORTH IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS MAILED TO YOU. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY EXECUTED THE PROXY.

CHINA AUTOMOTIVE SYSTEMS, INC.

No. 1 Guanshan 1stHenglong Road, WuhanYu Qiao Development Zone

Shashi District, Jing Zhou City, Hubei Province

The People’s Republic of China

(86) 27 8757 0028

----------------------------------------------------------------------------------

PROXY STATEMENT

----------------------------------------------------------------------------------

2013 ANNUAL MEETING OF STOCKHOLDERS

China Automotive Systems, Inc. (the “Company”) is furnishing this proxy statement in connection with the solicitation of proxies by the board of directors of the Company (the “Board of Directors”) for use at the annual meeting of Stockholders to be held on October 12, 2011 (Wednesday)August 20, 2013 (Tuesday) at 10:00 ama.m. local time at the conference room of the Ambassador Hotel, 818 WanhangduHenglong Conference Hall, No. 1 Henglong Road, Shanghai 200042Yu Qiao Development Zone, Shashi District, Jing Zhou City, Hubei Province, China and at any adjournments thereof (the “Annual Meeting”). This proxy statement and the Company’s annual report will be made available on internet on or before August 18, 2011.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholders Meeting to be Held on October 12, 2011August 20, 2013 - the Company’s Annual Report for the year ended December 31, 20112012 (the “Annual Report”) and this Proxy Statement are available at http://www.caasauto.com/Download.asp?sortid=312.

Only holders of the Company’s common stock as of the close of business on August 15, 2011June 25, 2013 (the “Record Date”) are entitled to vote at the Annual Meeting. Stockholders who hold shares of the Company in “street name” may vote at the Annual Meeting only if they hold a valid proxy from their broker. As of the Record Date, there were 28,083,53428,043,019 shares of common stock outstanding.

A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be present in person or by proxy in order for there to be a quorum at the meeting. Stockholders of record who are present at the meeting in person or by proxy and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, will be included in the number of stockholders present at the meeting for purposes of determining whether a quorum is present.

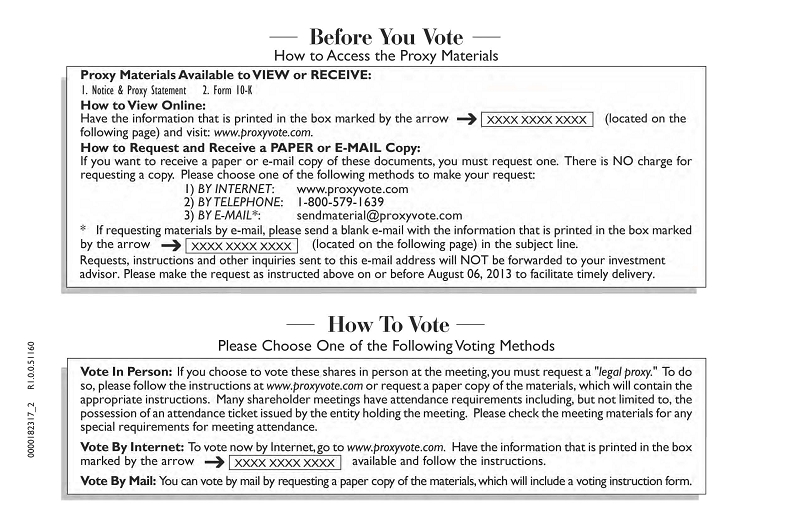

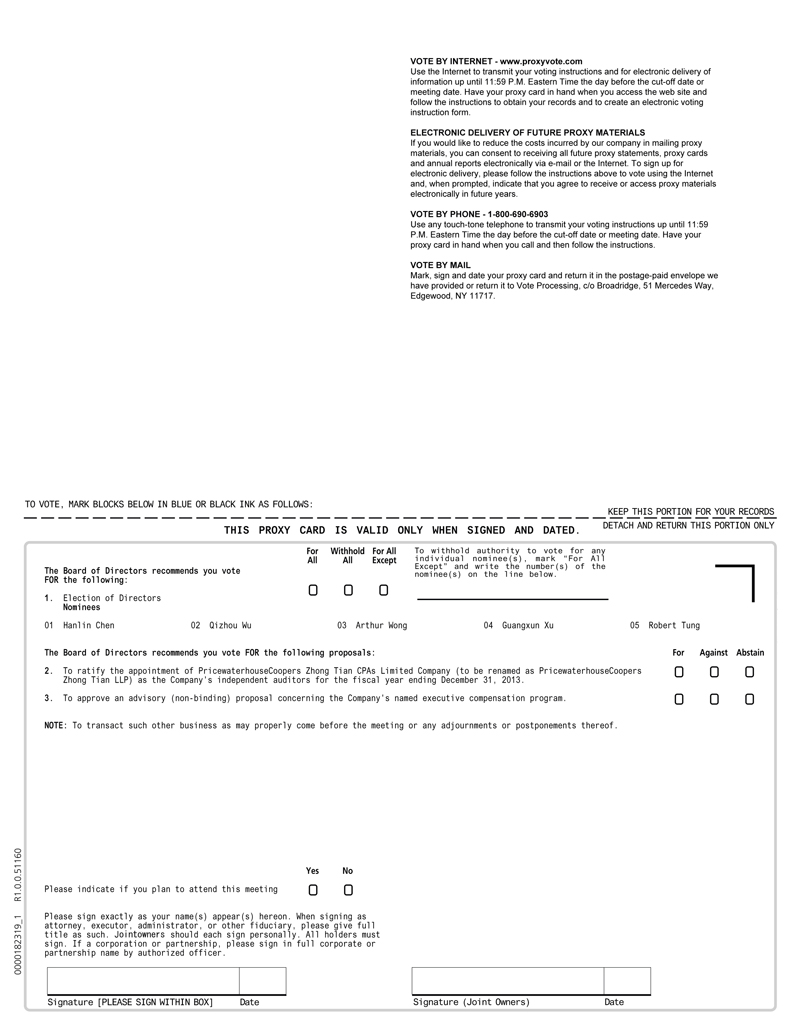

Each stockholder of record is entitled to one vote at the Annual Meeting for each share of common stock held by such stockholder on the Record Date. Stockholders do not have cumulative voting rights. Stockholders may vote their shares by executing the proxy following the instructions on the notice of internet availability of proxy materials (“Notice of Internet Availability of Proxy MaterialsAvailability”) mailed to the stockholders. All proxies received by the Company that are properly executed and have not been revoked will be voted in accordance with the instructions contained in the proxies. If paper copy of the proxy materials is requested by a stockholder and a signed proxy card is received that does not specify a vote or an abstention, the shares represented by that proxy card will be voted (i) for the nominees to the Board of Directors listed on the proxy card and in this proxy statement,statement; (ii) for the ratification of the appointment ofofPricewaterhouseCoopers Zhong Tian CPAs Limited Company (to be renamed as PricewaterhouseCoopers Zhong Tian CPA LLP)(“PwC”),as the Company’s independent auditors for the fiscal year ending December 31, 2011,2013; and (iii) for the (non-binding) approval of the Company’s named executive compensation program, and (iv) will be disregarded when considering the (non-binding) proposal on the frequency of advisory (non-binding) stockholder votes on the Company’s named executive compensation program. The Company is not aware, as of the date hereof, of any matters to be voted upon at the Annual Meeting other than those stated in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. If any other matters are properly brought before the Annual Meeting the proxy gives discretionary authority to the persons named as proxies to vote the shares represented by the proxy in their discretion.

Under Delaware law and the Company’s Certificate of Incorporation and Bylaws, if a quorum exists at the meeting, the affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors. A properly executed proxy marked “Withhold authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. For the (non-binding) vote on the frequency of advisory (non-binding) stockholder votes on the Company’s named executive compensation program, the frequency with the highest vote total is considered approved. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

For shares held in “street name” through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

A stockholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by (a) following the instructions on the website hosting proxy materials and voting as specified in the Notice of Internet Availability, or (b) if proxy is executed in paper form, delivering another duly executed proxy bearing a later date or (c) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless the stockholder actually votes in person at the meeting.

The proxy is solicited by the Board of Directors. The Company will pay all of the costs of soliciting proxies. In addition to solicitation by mail or through internet, officers, directors and employees of the Company may solicit proxies personally, or by telephone, without receiving additional compensation. The Company, if requested, will also pay brokers, banks and other fiduciaries who hold shares of Common Stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

BOARD OF DIRECTORS

The name, age and year in which the term expires of each member of the Board of Directors is set forth below:

| Name | Age | Position | Term Expires on the Date of the Annual Meeting Held in the Year | |||

| Hanlin Chen | 53 | Chairman | 2012 | |||

| Qizhou Wu | 46 | CEO and Director | 2012 | |||

| Guangxun Xu | 60 | Director | 2012 | |||

| Bruce Carlton Richardson | 53 | Director | 2012 | |||

| Robert Tung | 54 | Director | 2012 |

| Name | Age | Position | Term Expires on the Date of the Annual Meeting Held in the Year | |||

| Hanlin Chen’ | 56 | Chairman | 2013 | |||

| Qizhou Wu | 49 | CEO and Director | 2013 | |||

| Arthur Wong | 53 | Director | 2013 | |||

| Guangxun Xu | 62 | Director | 2013 | |||

| Robert Tung | 57 | Director | 2013 |

The Board of Directors has determined that the following directors for fiscal 2011year 2013 are “independent” under the current rules of the Nasdaq Stock Market: Arthur Wong, Guangxun Xu Bruce Carlton Richardson and Robert Tung.

At the Annual Meeting, the stockholders will vote on the election of Hanlin Chen, Qizhou Wu, Arthur Wong, Guangxun Xu Bruce Carlton Richardson and Robert Tung as directors to serve for a one-year term until the annual meeting of stockholders in 20122014 and until their successors are elected and qualified. All directors will hold office until the annual meeting of stockholders at which their terms expire and the election and qualification of their successors.

NOMINEES AND CONTINUING DIRECTORS

The following individuals have been nominated for election to the Board of Directors or will continue to serve on the Board of Directors after the Annual Meeting.

Hanlin Chen

Hanlin Chen has served as the chairman of the Boardboard of Directorsdirectors and an executive officer since March 2003. Since January 2013, Mr. Chen ishas become a standing boardcommittee member of the Chinese People’s Political Consulting Committee of Jingzhou CityConsultative Conference (CPPCC) and vice president of the Foreign Investors Association of Hubei Province. HeFrom 1993 to 1997, Mr. Chen was the general manager of Shashi Jiulong Power Steering Gears Co., Ltd. from 1993 to 1997. Since 1997, he has been the chairman of the board of directorsBoard of Henglong Automotive Parts, Ltd. Mr. Hanlin Chen is the brother-in-law of the Company’s senior vice president, Mr. Andy Yiu Wong Tse.

As chairman of the Board of Directors, Mr. Chen oversees the implementation of the Company’s business plan.

The Board of Directors concludedbelieves that Mr. Chen should be nominated and served as the chairman of the Board of Directors due to hisChen’s leadership and extensive knowledge of the Company all of which are essential to the development of the Company’s strategic vision.

Qizhou Wu

Qizhou Wu has served as a director and the chief operating officer of the Company since March 2003, and has beenbecome the chief executive officer of the Company since September 2007. Prior to that position he served as the chief operating officer from March 2003. He was the executive vice general manager of Shashi Jiulong Power Steering Gears Co., Ltd. from 1993 to 1999 and the general manager of Henglong Automotive Parts Co., Ltd. from 1999 to 2002. Mr. Wu graduated from Tsinghua University in Beijing with a M.S.Master’s degree in automobile engineering.

The Board of Directors concludedbelieves that Mr. Wu should be nominated and served as a director due to his leadershipWu’s experience and extensive knowledge of the Company all of which are essential to the developmentimplementation of the Company’s strategic vision.

Arthur Wong

Arthur Wong has served as abeen an independent director of the Company since December 2009,May 2012 and is the chairman of the audit committee and a member of the Company’s audit, compensation and nominating (for which he serves as chairman) committees of the Board of Directors. Mr. Xu has served as the chief representative of Nasdaq Stock Market in China from March 2007 to June 2009 and served as a managing director with the Nasdaq Stock Market International, Asia for over 10 years. Mr. Xu’s professional career in the finance field spans over 25 years, and focuses on providing package services on listings in the United Kingdom and United States, advising on and arranging for private placements, ‘PIPE’ transactions and initial public offerings (“IPOs”), pre-IPO restructuring, mergers and acquisitions, corporate and project finance, corporate governance, post-IPO investor relations, compliance and risk control. He holds an M.B.A. from Middlesex University, London.

The Board of Directors believes that Mr. Wong’s many years of experience working with public companies in the PRC and abroad provides perspective and global vision to the Company’s development.

Guangxun Xu

Guangxun Xu has served as an independent director of the Company since December 2009. He is a member of the audit and compensation committees, and the chairman of the nominating committee of the Board of Directors. Mr. Xu has been the Chief Representative of NASDAQ in China and a managing director of Xinhua Financethe NASDAQ Stock Market International, Asia for over 10 years. With a professional career in Shanghai from April 2006 until September 2007. He began his career with Arthur Andersen in New York, where he worked from 1989 to 1994 before returning to China.the finance field spanning over 25 years, Mr. Richardson earned a BA in classics from the University of Notre Dame in 1980,Xu’s practice focuses on providing package services on U.S. and graduated with an MA in international management from the University of Texas at Dallas in 1986. He was awarded a graduate study grant by the U.S. National Academy of Sciences in 1987U.K. listings, advising on and completed a year of post-graduate research on PRC accounting at People’s University in 1988.

The Board of Directors concludedbelieves that Mr. Richardson should be nominated and served as a director due to his strongXu’s many years of experience in working with public companies and financial and U.S. capital market experience, which is importantmarkets in Asia provides value to the Company’s business operations, risk assessmentBoard of Directors and capital market decisions.

Robert Tung

Robert Tung has served as abeenan independent director of the Company since September 2003, and2003. He is a member of the Company’s audit compensation (for which he serves as chairman) and nominating committees, and the chairman of the compensation committee of the Board of Directors. Mr. Tung is currently the president of Multi-Media Communications, Inc., and vice president of Herbal Blends International, LLC. Mr. Tung holds a M.S.Master’s degree in chemical engineering from the University of Virginia. Since 2003, Mr. Tung has been actively developing business in China. Currently,At present, Mr. Tung is the China operation vice president of Iraq Development Company of Canada, a leading North American corporation engaging in oil fieldoilfield and infrastructure development in the Republic of Iraq. In addition, Mr. Tung holds the Grand China sales representative position of TRI Products, Inc., a well-known North American iron oresore and scrap metals supplier. Mr. Tung is also actively involved in minerals, iron ore and petroleum derivatives purchase and trading.

The Board of Directors concludedbelieves that Mr. Tung should be nominated and served as a director due to hisTung’s many years of experience working with public companies.

Other than as noted above, there are no family relationships among any of the Company’s directors or executive officers.

DIRECTOR NOMINATION

Criteria for Board Membership.

In recommending candidates for appointment or re-election to the Board of Directors, the nominating committee of the Board of Directors (the “Nominating Committee”) considers the appropriate balance of experience, skills and characteristics required of the Board of Directors. It seeks to ensure that a majority of the directors are independent under the rules of the Nasdaq Stock Market, that the members of the Company’s audit committee of the Board of Directors (the “Audit Committee”) meet the financial literacy and sophistication requirements under the rules of the Nasdaq Stock Market and that at least one member of the Board qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission (the “SEC”).SEC. Nominees for director are recommended on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment and willingness to devote adequate time to Board of Directors duties.

Process for Identifying and Evaluating Nominees.

The Nominating Committee believes the Company is well served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for membership to the Board of Directors, the Nominating Committee will re-nominate incumbent directors who continue to be qualified for service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board of Directors occurs between annual stockholder meetings, the Nominating Committee will seek out potential candidates for appointment to the Board of Directors who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board of Directors, senior management of the Company and, if the Nominating Committee deems appropriate, a third-party search firm. The Nominating Committee will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the Nominating Committee. Candidates meriting serious consideration will meet with all members of the Board of Directors. Based on this input, the Nominating Committee will evaluate whether one of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board of Directors that such candidate be appointed to fill a then current vacancy or presented for the approval of the stockholders, as appropriate.

Stockholder Nominees.

The Nominating Committee will consider suggestions from stockholders regarding possible director candidates for election at the annual meeting to be held in 2012.2014. Any such nominations should be submitted to the Nominating Committee, c/o Mrs. Wei Na (secretary to the Board of Directors), and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualifications of the nominee, and should be submitted in the time frame described in the bylaws of the Company and under the caption, “Stockholder Proposals for 20122014 Annual Meeting” below. Each director nominated in this Proxy Statement was recommended for election by the Nominating Committee and by the Board of Directors. The Board of Directors did not receive any notice of a Board of Directors nominee recommendation in connection with this Proxy Statement from any security holder. The Company has never received a proposal from a stockholder to nominate a director.

Board Nominees for the 20112013 Annual Meeting.

The nominees listed in this proxy statement are the current five directors standing for re-election.

BOARD LEADERSHIP STRUCTURE

Mr. Hanlin Chen is currentlythe chairman of the Board of Directors and Mr. Qizhou Wu is the chief executive officer and a director of the Company. The Company believes that there are a wide arrayarrays of leadership structures that could apply to different business models and that every company should be afforded the opportunity to determine the ideal structure for its board leadership, which leadership structure may change over time. The Company’s leadership structure of a separate chairman of the Board of Directors and chief executive officer has historically proven extremely effective for it in the areas of performance and corporate governance, among others. The Company does not have a lead independent director. The Company, in consideration of the size of the Board of Directors and the presence of three independent directors who constitute a majority, believes that it is not necessary to appoint a lead independent director. The Board of Directors has determined that its current structure is in the best interests of the Company and its stockholders. The Company believes the independent nature of the audit, compensation and nominating committees of the Board of Directors also ensures that the Board of Directors maintains a level of independent oversight of management that is appropriate for the Company. The Board of Directors will review from time to time the appropriateness of its leadership structure and implement any changes it may deem necessary.

RISK OVERSIGHT

The Board of Directors has the ultimate oversight responsibility for the risk management process. A fundamental part of risk management is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. In setting the Company’s business strategy, the Board of Directors assesses the various risks being mitigated by management and determines what constitutes an appropriate level of risk for the Company. While the ultimate risk oversight rests with the Board of Directors, various committees of the Board of Directors also have responsibility for risk management. For example, the Audit Committee focuses on financial risk, including internal controls, and receives financial risk assessment reports from management, and risks related to the compensation programs are reviewed by the compensation committee of the Board of Directors (the “Compensation Committee”). The Board of Directors is advised by these committees of significant risks and management’s response via periodic updates.

DIRECTOR COMPENSATION

Based on the number of years of service to the Board of Directors, workload and performance, the Board of Directors decides on directordirectors’ compensation. The Board of Directors believes that the pay for the members of the board of directors was appropriate as of December 31, 2010. As effective2012. With effect from September 5, 2007,August 2, 2011, independent directors receive a director fee from the Company for their services as members of the Board of Directors and any committee of the Board of Directors in the amount of $7,000 ~ $10,000to $11,000 per quarter and thequarter. The chairman of the Audit Committee additionally receives an allowance of $6,000 per year. TheyPrior to August 2, 2011, the independent directors received a director fee from the Company for their services as members of the Board of Directors in the amount of $7,000 to $10,000 per quarter, and the chairman of the Audit Committee additionally receives an allowance of $6,000 per year. The directors are reimbursed for certain expenses in connection with attending Board of Directors and committee meetings of the Board of Directors. The Company has also granted, and expects to continue to grant, non-employee directors options to purchase shares of the Company’s common stock. The stockholders of the Company have approved certain director grants at the annual meeting of the stockholders in 2005, which grants were included in the 2004 stock option plan. The non-employee directors options granted and not expired over three years ago are as follows.

| ● | On June 28, 2005, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $6.83 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. |

| On July 6, 2006, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $7.94 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. |

| On September 5, 2007, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $7.01 per share over a period of four years. The exercise price represented the fair market value based on the grant date of the stock options. |

| On June 26, 2008, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $5.65 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. |

| On September 10, 2009, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $8.45 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. |

| On July 8, 2010, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $16.80 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. | ||

| ● | On October 12, 2011, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $4.84 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. | |

| ● | On August 15, 2012, the Company issued additional options to purchase 7,500 shares of common stock to each of its then three independent directors. Such stock options were vested immediately upon grant and are exercisable at $3.71 per share over a period of five years. The exercise price represented the fair market value based on the grant date of the stock options. |

Based on the number of the board of directors’ service years, workload and performance, the Company decides on theirthe directors’ pay. The management believes that the pay for the members of the Board of Directors was appropriate as of December 31, 2010.2012. The compensation that directors received for serving on the Board of Directors for fiscal year 20102012 was as follows:

| Name | Fees earned or paid in cash | Option awards1 | Total | |||||||||

| William E. Thomson | $ | 23,000 | $ | - | $ | 23,000 | ||||||

| Robert Tung | $ | 40,000 | $ | 115,125 | $ | 155,125 | ||||||

| Guangxun Xu | $ | 30,000 | $ | 115,125 | $ | 145,125 | ||||||

| Bruce C. Richardson | $ | 32,000 | $ | 115,125 | $ | 147,125 | ||||||

| Name | Fees earned or paid in cash | Option awards(1) | Total | |||||||||

| Robert Tung | $ | 44 | $ | 25 | $ | 69 | ||||||

| Guangxun Xu | $ | 36 | $ | 25 | $ | 61 | ||||||

| Arthur Wong | $ | 31 | $ | 25 | 56 | |||||||

| Bruce C. Richardson(2) | $ | 11 | $ | - | $ | 11 | ||||||

| Other than the cash payment based on the number of a director’s service years, workload and performance, the Company grants 7,500 option awards to each director every year. In accordance withASC Topic | ||

| (2) | Mr. Bruce C. Richardson resigned as a director of the Company on May 15, 2012. |

The cost of the above mentioned compensation paid to directors was measured based on investment, operating, technology, and consulting services they provided. AllNo other directors did not receivehad received any compensation for their service on the Board of Directors, except the three independent directors mentioned above.

BOARD MEETINGS AND COMMITTEES

The Board of Directors has standing audit, compensation and nominating committees. The Board of Directors met four (4)nine (9) times during fiscal 2010.2012. The Audit Committee met four (4)six (6) times, the Compensation Committee met four (4)three (3) times and the Nominating Committee met four (4)three (3) times during fiscal 2010.2012. Each member of the Board attended 75% or more of the aggregate of (i) the total number of Board meetings held during the period of such member’s service and (ii) the total number of meetings of Committees on which such member served, during the period of such member’s service. The audit, compensation and nominating committees’ charters are available on the Company’s website at www.caasauto.com.

Audit Committee.

The Audit Committee currently consists of Bruce Carlton RichardsonArthur Wong (chairman), Robert Tung and Guangxun Xu. The Board of Directors has determined that all members of the Audit Committee are independent directors under the rules of the Nasdaq Stock Market and each of them is able to read and understand fundamental financial statements. The Board of Directors has determined that Bruce Carlton RichardsonArthur Wong qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the Audit Committee include appointing and providing the compensation of the independent accountants to conduct the annual audit of our accounts, reviewing the scope and results of the independent audits, reviewing and evaluating internal accounting policies and approving all professional services to be provided to the Company by its independent accountants. The Audit Committee operates under a written charter that was included as Appendix C with the Company’s definitive proxy statement filed with the SEC on June 18,May 31, 2005.

Nominating Committee.

The Nominating Committee currently consists of Guangxun Xu (chairman), Robert Tung and Bruce Carlton Richardson,Arthur Wong, each of whom the Board of Directors has determined is an independent director under the rules of the Nasdaq Stock Market. The Nominating Committee’s responsibilities include recommending nominees for possible election to the Board of Directors and providing oversight with respect to corporate governance. The Nominating Committee operates under a written charter that was included as Appendix B to the Company’s definitive proxy statement filed with the SEC on June 18,May 31, 2005.

Compensation Committee.

The Compensation Committee currently consists of Robert Tung (chairman), Guangxun Xu and Arthur Wong. The Board has determined that all members of the Compensation Committee are independent directors under the rules of the Nasdaq Stock Market. The Compensation Committee administers the Company’s benefit plans, reviews and administers all compensation arrangements for executive officers and establishes and reviews general policies relating to the compensation and benefits of our officers and employees. The Compensation Committee operates under a written charter that was included as Appendix A with the Company’s definitive proxy statement filed with the SEC on May 31, 2005.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

For the twelve months ended December 31, 2010,2012, none of our executive officers had a relationship that would constitute an interlocking relationship with executive officers or directors of another entity or insider participation in compensation decisions.

COMMUNICATIONS WITH DIRECTORS

Stockholders interested in communicating directly with our Directorsmay email the Company’s independent directorchairman Mr. Bruce C. RichardsonHanlin Chen at bcrichardson@hotmail.com.chenhanlin@chl.com.cn. Mr. Richardson Chenwill review all such correspondence and will regularly forward to the other members of the Board of Directors copies of all such correspondence that deals with the functions of the Board of Directors or committees thereof or that he otherwise determines requires their attention. Directors may at any time review all of the correspondence received that is addressed to members of the Board of Directors and request copies of such correspondence. Concerns relating to accounting, internal controls or auditing matters will immediately be brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

The Company has a policy of encouraging all directors to attend the annual stockholder meetings. This will be the seventh annual meeting since the Company’s change in the Board of Directors and Management in March, 2003, as more clearly described in Part I, Item I. “Business” of the Company’s most recent annual report on Form 10-K as filed with the SEC on June 28, 2011. Last year, five (5) directors attended the annual meeting.

CODE OF CONDUCT AND ETHICS

The Company has adopted a code of conduct and ethics that applies to all directors, officers and employees, including its principal executive officer, principal financial officer and controller. This code of conduct and ethics was filed as Exhibit 99.1 to the Company’s Annual Report on Form 10-KSB/A for the fiscal year ended December 31, 2003 filed with the SEC.

SECURITY OWNERSHIP OF DIRECTORS AND

OFFICERS AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information known to the Company with respect to the beneficial ownership of the Company’s common stock as of June 28, 2011December 31, 2012 by (i) each person who is known by the Company to own beneficially more than 5% of the Company’s common stock, (ii) each of the Company’s directors and executive officers and (iii) all executive officers and directors as a group. Except as otherwise listed below, the address of each person is c/o China Automotive Systems, Inc., Henglong Building, Optics Valley Software Park, No. 1 Guanshan 1st Road, East Lake Hi-Tech Zone, Wuhan City, Hubei Province, The People’s Republic of China. Percentage ownership is based upon 28,083,53428,043,019 shares outstanding as of June 28, 2011.

| Name/Title | Total Number of Shares | Percentage Ownership | ||||||

Hanlin Chen, chairman of the Board of Directors1 | 17,767,314 | 63.27 | % | |||||

| Qizhou Wu, chief executive officer and director | 1,399,736 | 4.98 | % | |||||

| Jie Li, chief financial officer | 5,133 | 0.02 | % | |||||

Li Ping Xie2 | 17,767,314 | 63.27 | % | |||||

| Andy Yiu Wong Tse, senior vice-president | 372,704 | 1.33 | % | |||||

| Shaobo Wang, senior vice-president | 156,104 | 0.56 | % | |||||

| Shengbin Yu, senior vice-president | 207,429 | 0.74 | % | |||||

| Yijun Xia, vice-president | 3,734 | 0.01 | % | |||||

| Daming Hu, chief accounting officer | 9,000 | 0.03 | % | |||||

| Guangxun Xu, director | - | - | % | |||||

| Bruce Carlton Richardson, director | - | - | % | |||||

| Robert Tung, director | - | - | % | |||||

| Dr. Haimian Cai, former director, vice-president | 3,750 | 0.01 | % | |||||

Wiselink Holdings Limited3 | 3,023,542 | 10.77 | % | |||||

| All Directors and Executive Officers (12 persons) | 19,924,904 | 70.95 | % | |||||

| Name/Title | Total Number of Shares | Percentage Ownership | ||||||

| Hanlin Chen, Chairman(1) | 17,849,014 | 63.65 | % | |||||

| Qizhou Wu, CEO and Director | 1,445,136 | 5.15 | % | |||||

| Jie Li, CFO | 33,403 | 0.12 | % | |||||

| Li Ping Xie(2) | 17,849,014 | 63.65 | % | |||||

| Tse, Yiu Wong Andy, Sr. VP, Director | 400,204 | 1.43 | % | |||||

| Shaobo Wang, Sr. VP | 165,104 | 0.59 | % | |||||

| Shengbin Yu, Sr. VP | 246,429 | 0.88 | % | |||||

| Yijun Xia, VP | 17,200 | 0.06 | % | |||||

| Daming Hu, CAO | 26,400 | 0.09 | % | |||||

| Robert Tung, Director | 7,500 | 0.03 | % | |||||

| Haimian Cai, Director | 3,750 | 0.01 | % | |||||

| Wiselink Holdings Limited(3) | 17,849,014 | 63.65 | % | |||||

| All Directors and Executive Officers (12 persons) | 20,194,140 | 72.01 | % | |||||

| Includes | |||||||

| Includes | |||||||

Includes 13,322,547 shares of common stock beneficially owned by Mr. Hanlin Chen and 1,502,925 shares of common stock beneficially owned by Mr. Hanlin Chen’s wife, Ms. Li Ping Xie. Wiselink Holdings Limited is a company controlled by Mr. Hanlin Chen. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS1

The following related parties are related through common ownership with the major stockholders of the Company:

| Jingzhou Henglong Fulida Textile Co., Ltd. |

| Xiamen Joylon Co., Ltd., “Xiamen Joylon” |

| Shanghai Tianxiang Automotive Parts Co., Ltd., “Shanghai Tianxiang” |

| Shanghai Fenglong Materials Co., Ltd., “Shanghai Fenglong” |

| Changchun Hualong Automotive Technology Co., Ltd., “Changchun Hualong” |

| Jiangling Tongchuang Machining Co., Ltd., “Jiangling Tongchuang” |

| Beijing Hualong Century Digital S&T Development Co., Ltd., “Beijing Hualong” |

| Jingzhou Jiulong Material Co., Ltd., “Jiulong Material” |

| Shanghai Hongxi Investment Inc., “Hongxi” |

| Hubei Wiselink Equipment Manufacturing Co., Ltd., “Hubei Wiselink” |

| Jingzhou Tongyi Special Parts Co., Ltd., “Jingzhou Tongyi” |

| Jingzhou Derun Agricultural S&T Development Co., Ltd., “Jingzhou Derun” |

| Jingzhou Tongying Alloys Materials Co., Ltd., “Jingzhou Tongying” |

| Wuhan Dida Information S&T Development Co., Ltd., “Wuhan Dida” |

| Hubei Wanlong Investment Co., Ltd., “Hubei Wanlong” |

| Jiangling Yude Machining Co., Ltd., “Jiangling Yude” |

| Wiselink Holdings Limited., “Wiselink” | ||

| ● | Beijing Henglong Automotive System Co., Ltd., “Beijing Henglong” | |

| ● | Honghu Changrun Automotive Parts Co., Ltd., “Honghu Changrun” |

Related Party Transactions

The Company’s related party transactions include product sales, material purchases and purchases of equipment and technology. These transactions were consummated at fair market price and under similar terms as those with the Company's customers and suppliers. On some occasions, the Company’s related party transactions also include purchase/sale of capital stock of the joint ventures and sale of property, plant and equipment.

Related sales and purchases: During the years ended December 31, 2010, 20092012 and 2008,2011, the joint-venturesjoint ventures entered into related party transactions with companies with common directors as shown below:

Merchandise Sold to Related Parties

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Xiamen Joylon | $ | 9,871,977 | $ | 4,850,977 | $ | 2,143,418 | ||||||

| Shanghai Fenglong | 526,182 | 400,001 | 166,885 | |||||||||

| Jiangling Yude | 1,262,343 | 641,186 | 2,365,107 | |||||||||

| Total | $ | 11,660,502 | $ | 5,892,164 | $ | 4,675,410 | ||||||

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

| Honghu Changrun | $ | 81 | $ | - | ||||

| Xiamen Joylon | 7,055 | 16,166 | ||||||

| Shanghai Fenglong | 377 | 519 | ||||||

| Hubei Wiselink | - | 1,413 | ||||||

| Jiangling Yude | 103 | 1,018 | ||||||

| Beijing Henglong | 19,826 | 24,058 | ||||||

| Total | $ | 27,442 | $ | 43,174 | ||||

Technology sold to Related Parties

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

| Beijing Henglong | $ | 86 | $ | - | ||||

| Total | $ | 86 | $ | - | ||||

Materials Purchased from Related Parties

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Honghu changrun | $ | 81,266 | $ | — | $ | 9,547 | ||||||

| Shanghai Fenglong | — | 17,273 | 136,990 | |||||||||

| Jiangling Tongchuang | 9,187,392 | 7,078,698 | 5,485,206 | |||||||||

| Jingzhou Tongyi | 785,649 | 489,116 | 285,347 | |||||||||

| Jingzhou Tongying | 9,198,373 | 6,216,739 | 1,984,854 | |||||||||

| Hubei Wiselink | - | 196,876 | — | |||||||||

| Total | $ | 19,252,680 | $ | 13,998,702 | $ | 7,901,944 | ||||||

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

| Honghu Changrun | $ | 1,018 | $ | 1,104 | ||||

| Jiangling Tongchuang | 7,653 | 8,858 | ||||||

| Jingzhou Tongying | 9,436 | 9,153 | ||||||

| Hubei Wiselink | 1,190 | 923 | ||||||

| Wuhan Tongkai | 693 | 651 | ||||||

| Total | $ | 19,990 | $ | 20,689 | ||||

Technology Purchased from Related Parties

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

| Changchun Hualong | $ | 365 | $ | 218 | ||||

| Honghu Changrun | 317 | - | ||||||

| Beijing Hualong | 137 | - | ||||||

| Total | 819 | 218 | ||||||

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Changchun Hualong | $ | 178,972 | $ | 248,916 | $ | 321,892 | ||||||

Equipment Purchased from Related Parties

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Hubei Wiselink | $ | 1,873,898 | $ | 3,962,690 | $ | 3,031,072 | ||||||

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

| Hubei Wiselink | $ | 4,250 | $ | 4,724 | ||||

Related receivables, advance payments and account payable: As at December 31, 20102012 and 2009,2011, accounts receivables, advance payments and account payable between the Company and related parties are as shown below:

Accounts receivables from Related Parties

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| Xiamen Joylon | $ | 5,046,397 | $ | 1,214,682 | ||||

| Shanghai Fenglong | 212,658 | 193,595 | ||||||

| Jiangling Yude | 207,787 | 33,662 | ||||||

| Total | $ | 5,466,842 | $ | 1,441,939 | ||||

| December 31, | ||||||||

| 2012 | 2011 | |||||||

| Xiamen Joylon | $ | 4,182 | $ | 5,999 | ||||

| Shanghai Fenglong | 208 | 104 | ||||||

| Jiangling Yude | 903 | 22 | ||||||

| Jingzhou Tongying | 604 | - | ||||||

| Beijing Henglong | 6,389 | 5,394 | ||||||

| Total | $ | 12,286 | $ | 11,519 | ||||

Other Receivables from Related Parties

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| Jiangling Tongchuang | $ | — | $ | 3,515 | ||||

| Wuhan Dida | 59,846 | 61,901 | ||||||

| Jiulong Material | 564,074 | 537,300 | ||||||

| Jiangling Yude | 136,393 | — | ||||||

| Jingzhou Tongying | 154,225 | — | ||||||

| Total | 914,538 | 602,716 | ||||||

| Less: provisions for bad debts | (564,074 | ) | (537,300 | ) | ||||

| Balance at end of year | $ | 350,464 | $ | 65,416 | ||||

| December 31, | ||||||||

| 2012 | 2011 | |||||||

| Wuhan Dida | $ | 78 | $ | 64 | ||||

| Jiulong Material | 608 | 638 | ||||||

| Jiangling Yude | - | 436 | ||||||

| Jingzhou Derun | 3 | - | ||||||

| Jiangling Tongchuang | 5 | - | ||||||

| Honghu Changrun | 6 | - | ||||||

| Wuhan Tongkai | 15 | - | ||||||

| Total | 715 | 1,138 | ||||||

| Less: provisions for bad debts | (608 | ) | (638 | ) | ||||

| Balance at end of year | $ | 107 | $ | 500 | ||||

Other receivables from related parties are primarily unsecured demand loans, with no stated interest rate or due date.

Accounts payable fromto Related Parties

| December 31, | ||||||||

| 2012 | 2011 | |||||||

| Shanghai Tianxiang | $ | 362 | $ | 661 | ||||

| Jiangling Tongchuang | 1,791 | 259 | ||||||

| Hubei Wiselink | 520 | 695 | ||||||

| Jingzhou Tongyi | - | 7 | ||||||

| Jingzhou Tongying | 1,508 | 362 | ||||||

| Wuhan Tongkai | 184 | - | ||||||

| Honghu Changrun | 156 | 69 | ||||||

| Total | $ | 4,521 | $ | 2,053 | ||||

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| Shanghai Tianxiang | $ | 629,183 | $ | 610,246 | ||||

| Jiangling Tongchuang | 263,246 | 63,314 | ||||||

| Hubei Wiselink | 509,898 | 328,366 | ||||||

| Jingzhou Tongyi | 51,561 | 9,136 | ||||||

| Jingzhou Tongying | 414,038 | 526,765 | ||||||

| Total | $ | 1,867,926 | $ | 1,537,827 | ||||

Advanced equipment payments to Related Parties

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| Hubei Wiselink | $ | 7,534,440 | $ | 2,579,319 | ||||

| December 31, | ||||||||

| 2012 | 2011 | |||||||

| Hubei Wiselink | $ | 4,162 | $ | 3,712 | ||||

Other advance payments to related parties and others

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| Jiangling Tongchuang | $ | 405,266 | $ | — | ||||

| Jingzhou Tongyi | 875,619 | — | ||||||

| Honghu changrun | 53,184 | — | ||||||

| Total | $ | 1,334,069 | $ | — | ||||

| December 31, | ||||||||

| 2012 | 2011 | |||||||

| Jiangling Tongchuang | $ | 542 | $ | 509 | ||||

| Jingzhou Tongyi | - | 2 | ||||||

| Jingzhou Tongying | 62 | 72 | ||||||

| Changchun Hualong | 159 | - | ||||||

| Jingzhou Derun | 13 | - | ||||||

| Honghu Changrun | 3 | 47 | ||||||

| Total | $ | 779 | $ | 630 | ||||

The Company's related parties, such as Jingzhou Fulida, Hubei Wiselink, Jingzhou Derun and Wuhan Dida, pledged certain land use rights and buildings as security for the Company’s comprehensive credit facility.

As of June 28, 2011,March 27, 2013, Mr. Hanlin Chen Chairman, owns 63.27%63.65% of the common stock of the Company and has the effective power to control the vote on substantially all significant matters without the approval of other stockholders.

SECTION 16(a) BENEFICIAL OWNERSHIP COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and directors and persons who own more than 10% of a registered class of the Company’s equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of common stock and other of the Company’s equity securities, on Forms 3, 4 and 5 respectively. Executive officers, directors and greater than 10% stockholders are required by Commission regulations to furnish the Company with copies of all Section 16(a) reports they file. To the best of the Company’s knowledge, based solely upon a review of the Form 3, 4 and 5 filed, no officer, director or 10% beneficial stockholder failed to file on a timely basis any reports required by Section 16(a) exceptof the filing made by Wiselink Holdings Ltd,Securities Exchange Act of 1934, as disclosed on Form 4 and filed with the SEC on June 28, 2011.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee is responsible for setting the Company’s policies regarding compensation and benefits and administering the Company’s benefit plans. At the end of fiscal year 2010,2012, the Compensation Committee consisted of Robert Tung (chairman), Guangxun Xu and Bruce Carlton Richardson.Arthur Wong. The members of the Compensation Committee approved the amount and form of compensation paid to executive officers of the Company and set the Company’s compensation policies and procedures during these periods.

The primary goals of the Compensation CommitteeCompany’s compensation committee with respect to executive compensation are to attract and retain highly talented and dedicated executives and to align executives’ incentives with stockholder value creation. The Compensation Committee evaluates an individual executive’s work experience, time and involvement in the Company, position and personal performance, all with a goal to setting compensation levels that are comparable with executives at companies that are of the same size and stage of development and operate in the same area and industry.

The Compensation Committee will conduct an annual review of the aggregate level of the Company’s executive compensation, as well as the mix of elements used to compensate the Company’s executive officers. The Company compares compensation levels with amounts currently being paid to executives at similar companies in the same area and the same industry. TheMost importantly, the Company also compares compensation levels with local practices in China. The Company believes that its compensation levels are competitive with local conditions.

Elements of compensation

The Company’s executive compensation consists of the following elements.

Base Salary

Base salaries for the Company’s executives are established to be amounts of compensation that are similar to those paid by other companies to executives in similar positions and with similar responsibilities. Base salaries are adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance and experience. The Compensation Committee established a salary structure to determine base salaries and is responsible for initially setting executive officer compensation in employment arrangements with each individual. The base salary amounts are intended to reflect the Company’s philosophy that the base salary should attract experienced individuals who will contribute to the success of the Company’s business goals and represent cash compensation that is commensurate with the compensation of individuals at similarly situated companies.

The Company’s Board of Directors and Compensation Committee have approved the current salaries for executives: $150,000RMB1.30 million ($0.21 million) for the Chairman, $100,000RMB0.90 million ($0.14 million) for the CEO, and $60,000RMB0.5 million ($0.08 million) individually for other officers in 2010.

Performance Bonus

The Company awards a performance bonus to certain executives based on the achievement of set goals. The performance bonuses awarded to executives for this year are as follows:

| Grantees: | Hanlin Chen, Qizhou Wu, Shengbin Yu, Shaobo Wang, Andy Tse, Jie Li, Yijun Xia and Daming Hu. |

| Conditions: |

| Bonus: |

There were no accrued performance bonuses for Named Executive Officers in 2012 as the Company did not reach the above conditions for awarding performance bonus of $305,000 were accrued in 2010 and have been paid by the end of July, 2011.

Stock Option Awards

The stock options plan proposed by management, which aims to incentivize and retain core employees, to meet employees’ benefits, the Company’s long term operating goals and shareholderstockholder benefits, was approved at the 2004 Annual Meeting of Stockholders, and the maximum common shares for issuance under this plan is 2,200,000 with a period of 10 years.

The Company has notstock options granted any stock option to management in 2010 and 2009. The stock option granted for management in 2008 waswere as follows, which waswere approved by the Board of Directors and the Compensation Committee.

Total Number of Options Granted: | 298,850 |

| Exercise Price Per Option: |

| Date of Grant: | December 10, 2008 |

| Expiration Date: |

| Vesting |

| On December 10, 2008, 1/3 of the granted stock option |

| On December 10, 2009, |

| On December 10, 2010, |

There were no stock options granted to management in 2012.

Other Compensation

Other than the base salary for the Company’s executive officers, the performance bonus and the stock option awards referred to above, the Company does not have any other benefits and perquisites for its executive officers.Named Executive Officers. However, the Compensation Committee in its discretion may provide benefits and perquisites to these executive officers if it deems advisable to do so.

Option Exercises and Stock Vested.

During the fiscal year 2012, the following numbers of shares were acquired and Mr. Yijun Xia exercised 5,133 and 3,734 options, respectively,values realized for the following named executive officers of the Company under the 2008 stock option plan granted for management, during the fiscal year ended December 31, 2010. None of the Company’s executive officer holds any restricted stock that vested during the last fiscal year.plan:

| Option Awards | ||||||||

| Name | Number of Shares Acquired on Exercise | Value Realized on Exercise | ||||||

| N/A. | $ | 0 | $ | 0 | ||||

Employment contracts and termination of employment

All of the Company’s executive officers have executed standard employment agreements with the Company, which are governed underby PRC law. Other than the amount of compensation, the terms and conditions of the employment agreements with the executive officers are substantially the same as those of the Company’s standard employment agreements with non-executive employees. The Company’s standard employment agreements are for a fixed period of threefive (5) years and may be renewed upon notice from the employee and consent of the Company. The Company may terminate an employment agreement upon thirty days’ notice if an employee is not suitable for the job due to medical or other reasons. An employee may terminate his or her employment agreement without cause upon one month’s notice. The compensation stated in the agreement is the basic salary and is subject to adjustment on an annual basis.

Role of Executives in Executive Compensation Decisions

The Compensation Committee seeks input from our chairman and chief executive officer when discussing the performance of, and compensation levels for, executives other than such persons. None of our executives participate in deliberations relating to his own compensation. In particular, the Compensation Committee seeks input from our chairman and chief executive officer in assessing the performance of individual executive officers, assessing competitive conditions in the market for retaining key employees and establishing the Company’s business goals and financial objectives which are used by the Compensation Committee in setting compensation levels.

Compensation of Executive Officers

The following represents the compensation for our named executive officers.

| Hanlin Chen, the Company’s Chairman, has a renewed employment agreement that became effective as of September 25, | ||

| ● | Qizhou Wu, the Company’s CEO, has an employment agreement that became effective as of September 25, 2012. The agreement is for an indefinite term pursuant to the PRC employment law. Mr. Wu received an annual salary of approximately $140,000 during the fiscal year ended December 31, 2012. | |

| ● | Haimian Cai, the Company’s Vice President, has an employment agreement that became effective as of July 8, 2010. The agreement is for a term of five (5) years. Mr. |

Summary Compensation Table

The following table sets forth information regarding compensation for the fiscal year ended December 31, 20102012 received by our Chairman, the Chief Executive Officer and the “named“Named Executive Officers.”

The compensation that executive officers.”

| Name and principal position | Year | Salary(1) | Bonus(2) | Option Awards(3) | Total | |||||||||||||

| Hanlin Chen (Chairman) | 2012 | $ | 210 | $ | - | $ | - | $ | 210 | |||||||||

| 2011 | $ | 165 | $ | - | $ | - | $ | 165 | ||||||||||

| Qizhou Wu (CEO) | 2012 | $ | 140 | $ | - | $ | - | $ | 140 | |||||||||

| 2011 | $ | 110 | $ | - | $ | - | $ | 110 | ||||||||||

| Haimian Cai (Vice President) | 2012 | $ | 150 | $ | - | $ | - | $ | 150 | |||||||||

| 2011 | $ | 96 | $ | - | $ | - | $ | 96 | ||||||||||

| (1) | Salary – Please refer to Base Salary disclosed under “Elements of compensation” section above for further details. | |

| (2) | Bonus – Please refer to Performance Bonus disclosed under “Elements of compensation” section above for further details. | |

| (3) | Option Awards – Please refer to Stock Option Awards disclosed under “Elements of compensation” section above for further details. |

| Name and principal position | Year | Salary1 | Bonus2 | Option Awards3 | Total | |||||||||||||

| Hanlin Chen (Chairman) | 2010 | $ | 150,000 | $ | 75,000 | $ | — | $ | 225,000 | |||||||||

| 2009 | $ | 150,000 | $ | 75,000 | $ | — | $ | 225,000 | ||||||||||

| 2008 | $ | 150,000 | $ | — | $ | — | $ | 150,000 | ||||||||||

| Qizhou Wu (CEO) | 2010 | $ | 100,000 | $ | 50,000 | $ | — | $ | 150,000 | |||||||||

| 2009 | $ | 100,000 | $ | 50,000 | $ | — | $ | 150,000 | ||||||||||

| 2008 | $ | 100,000 | $ | — | $ | — | $ | 100,000 | ||||||||||

| Jie Li (CFO) | 2010 | $ | 60,000 | $ | 30,000 | $ | — | $ | 90,000 | |||||||||

| 2009 | $ | 60,000 | $ | 30,000 | $ | — | $ | 90,000 | ||||||||||

| 2008 | $ | 60,000 | $ | — | $ | 38,654 | $ | 98,654 | ||||||||||

| Haimian Cai (Vice President) | 2010 | $ | 96,000 | $ | — | $ | — | $ | 96,000 | |||||||||

| 2009 | $ | 40,000 | $ | 96,000 | $ | 65,550 | $ | 201,550 | ||||||||||

| 2008 | $ | 34,000 | $ | — | $ | 51,225 | $ | 85,225 | ||||||||||

| Shengbin Yu (Senior Vice President) | 2010 | $ | 60,000 | $ | 30,000 | $ | — | $ | 90,000 | |||||||||

| 2009 | $ | 60,000 | $ | 30,000 | $ | — | $ | 90,000 | ||||||||||

| 2008 | $ | 60,000 | $ | — | $ | — | $ | 60,000 | ||||||||||

For detailed information on option exercises and stock vested, please see Note 24 in the Notes19 to the Consolidated Financial Statements under Item 15 ofconsolidated financial statements in the Annual Report on Form 10-K as filed with the SEC on June 28, 2011 for more details.

REPORT OF THE AUDIT COMMITTEE

Under the guidance of a written charter adopted by the Board of Directors, the purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the Audit Committee include appointing and providing for the compensation of the independent accountants. Each of the members of the Audit Committee meets the independence requirements of the Nasdaq Stock Market.

Management has primary responsibility for the system of internal controls and the financial reporting process. The independent accountants have the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards.

In this context and in connection with the audited financial statements contained in the Company’s Annual Report on Form 10-K for 2010,2012, the Audit Committee:

| reviewed and discussed the audited financial statements as of and for the fiscal year ended December 31, | ||

| discussed with | ||

| reviewed the written disclosures and the letter from | ||

| based on the foregoing reviews and discussions, recommended to the Board of Directors that the audited financial statements be included in the Company’s | ||

| instructed the independent auditors that the Audit Committee expects to be advised if there are any subjects that require special attention. | ||

AUDIT COMMITTEE

Arthur Wong (chairman), Robert Tung and Guangxun Xu.

Audit Committee’s Pre-Approval Policy

During fiscal years ended December 31, 20102012 and 2009,2011, the Audit Committee of the Board of Directors adopted policies and procedures for the pre-approval of all audit and non-audit services to be provided by the Company’s independent auditor and for the prohibition of certain services from being provided by the independent auditor. The Company may not engage the Company’s independent auditor to render any audit or non-audit service unless the service is approved in advance by the Audit Committee or the engagement to render the service is entered into pursuant to the Audit Committee’s pre-approval policies and procedures. On an annual basis, the Audit Committee may pre-approve services that are expected to be provided to the Company by the independent auditor during the fiscal year. At the time such pre-approval is granted, the Audit Committee specifies the pre-approved services and establishes a monetary limit with respect to each particular pre-approved service, which limit may not be exceeded without obtaining further pre-approval under the policy. For any pre-approval, the Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence.

Principal Accountant Fees and Services

The following table sets forth the aggregate fees for professional audit services rendered by Schwartz Levitsky Feldman LLP PwCfor the audit of the Company’s annual financial statements, and fees billed for other services for the fiscal years 20102012 and 2009.2011. The Audit Committee has approved all of the following fees.

| Fiscal Year Ended | ||||||||

| 2010 | 2009 | |||||||

| Audit Fees | $ | 78,000 | $ | 265,000 | ||||

Audit-Related Fees1 | — | — | ||||||

Tax Fees2 | — | 8,400 | ||||||

| Total Fees Paid | $ | 78,000 | $ | 273,400 | ||||

| Fiscal Year Ended | ||||||||

| 2010 | 2009 | |||||||

| Audit Fees | $ | 823,000 | $ | — | ||||

Audit-Related Fees1 | — | — | ||||||

Tax Fees2 | — | — | ||||||

| Total Fees Paid | $ | 823,000 | $ | — | ||||

| Fiscal Year Ended | ||||||||

| 2012 | 2011 | |||||||

| Audit Fees | $ | 820 | $ | 870 | ||||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | - | - | ||||||

| Total Fees Paid | $ | 820 | $ | 870 | ||||

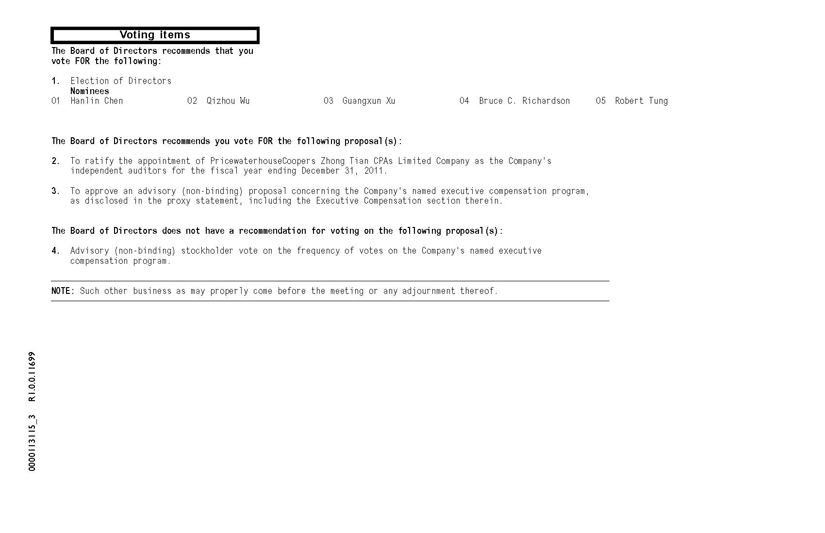

PROPOSAL 1 — ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will vote on the election of five directors to serve for a one-year term until the 20122014 annual meeting of stockholders and until their successors are elected and qualified. The Board of Directors has unanimously approved the nomination of Hanlin Chen, Qizhou Wu, Arthur Wong, Guangxun Xu Bruce Carlton Richardson and Robert Tung for election to the Board of Directors. The nominees have indicated that they are willing and able to serve as directors. If any of these individuals becomes unable or unwilling to serve, the accompanying proxy may be voted for the election of such other person as shall be designated by the Board of Directors. The Directors will be elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting, assuming a quorum is present. Stockholders do not have cumulative voting rights in the election of directors.

The Board of Directors recommends a vote “for”the election of Hanlin Chen, Qizhou Wu,

Unless otherwise instructed, it is the intention of the persons named in the proxy to vote shares represented by properly executed proxy for the election of Hanlin Chen, Qizhou Wu, Arthur Wong, Guangxun Xu Bruce Carlton Richardson and Robert Tung.

PROPOSAL 2 — RATIFICATION OF INDEPENDENT AUDITORS

At the Annual Meeting, the stockholders will be asked to ratify the appointment of PricewaterhouseCoopers Zhong Tian CPA PwCas the Company’s independent auditors for the fiscal year ending December 31, 2011.2013. Representatives of PricewaterhouseCoopers Zhong Tian CPA PwCare expected to be present at the Annual Meeting and will have the opportunity to make statements if they desire to do so. Such representatives are also expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote “for” the ratification of the appointment of PricewaterhouseCoopers Zhong Tian CPAPwC as the Company’s independent auditors for the fiscal year ending December 31, 2011.

PROPOSAL 3 — APPROVAL OF EXECUTIVE COMPENSATION

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enables the Company’s stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of the named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules, commonly referred to as a “Say-on-Pay.”

As described under the heading “Executive Compensation—Compensation - Compensation Discussion and Analysis,”Analysis” section of this proxy statement, the Company’s executive compensation program is designed to attract, motivate and retain our named executive officers, who are critical to the Company’s success. The Company believes that the various elements of its executive compensation program work together to promote its goal of ensuring that total compensation should be related to both the Company’s performance and individual performance.

Stockholders are urged to read the “Executive Compensation—Compensation - Compensation Discussion and Analysis” section of this proxy statement, which discusses how the Company’s executive compensation policies implement its compensation philosophy, and thephilosophy. The “Executive Compensation—Compensation - Compensation of Executive Officers” section and the “Executive Compensation - Summary Compensation Table” section of this proxy statement which containscontain narrative discussion and tabular information about the compensation of the Company’s named executive officers, including information about fiscal 2010year 2011 compensation of the Company’s named executive officers. The Compensation Committee and the Company’s Board of Directors believe that these policies are effective in implementing the Company’s compensation philosophy and in achieving its goals.

The Company is asking its stockholders to indicate their support for its executive compensation as described in this proxy statement. This Say-on-Pay proposal gives the Company’s stockholders the opportunity to express their views on its named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, the Company is asking its stockholders to approve, on an advisory basis, the compensation of the named executive officers, as disclosed in this Proxy Statementproxy statement pursuant to the compensation disclosure rules of the SEC, including the “Executive Compensation - Compensation Discussion and AnalysisAnalysis” section and the other related tables and disclosure.disclosures.

The Say-on-Pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or the Board of Directors. However, the Company’s Board of Directors and its Compensation Committee value the opinions of the stockholders and, to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, the Company will consider stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

The Board of Directors recommends voting “for” the approval of the Company’s executive compensation program, as described in the “Executive Compensation—Compensation - Compensation Discussion and Analysis” and “Executive Compensation—Compensation - Compensation of Executive Officers” sections of this proxy statement.

INCORPORATION BY REFERENCE

The SEC allows the Company to “incorporate by reference” information into this proxy statement, which means that the Company can disclose important information to you by referring you to other documents that we have filed separately with the SEC and made available to you with the copy of this proxy statement. The information incorporated by reference is deemed to be part of this proxy statement. This proxy statement incorporates by reference the financial statements of the Company as contained in the Company’s annual reportAnnual Report on Form 10-K filed by the Company on June 28, 2011,March 27, 2013, which is made available together with this proxy statement on the website specified above to all stockholders in connection with the annual meeting.

OTHER MATTERS

As of the time of preparation of this proxy statement, neither the Board of Directors nor management intends to bring before the meeting any business other than the matters referred to in the Notice of Annual Meeting and this proxy statement. If any other business should properly come before the meeting, or any adjournment thereof, the persons named in the proxy will vote on such matters according to their best judgment.

STOCKHOLDER PROPOSALS FOR 20122014 ANNUAL MEETING

Under the rules of the SEC, stockholders who wish to submit proposals for inclusion in the proxy statement of the Board of Directors for the 20122014 Annual Meeting of Stockholders must submit such proposals so as to be received by the Company at China Automotive Systems, Inc., Henglong Building, Optics Valley Software Park, No. 1 Guanshan 1stHenglong Road, WuhanYu Qiao Development Zone, Shashi District, Jing Zhou City, Hubei Province, The People’s Republic of China on or before May 31, 2012.

| By Order of the Board of Directors | |

Chen Hanlin Chairman |

Hubei, People’s Republic of China

June 26, 2013

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE EXECUTE THE PROXY FOLLOWING THE INSTRUCTIONS SET FORTH IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS MAILED TO YOU. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY EXECUTED THE PROXY.